Originally this blog entry was posted on aperventures.com

They say VC investment is like a marriage. We have celebrated our 6th year with The Batteries team with almost $8.2M follow-on.

For the better part of that time, the battery was not just an essential component of electronic devices. It has become the heart of a laptop, phone or tablet, and for ⅓ of users has become the main reason to throw those devices away after three or four years. In Aper Ventures, we believe that each of us will have superbattery in our device in the coming years, allowing for 5x as many chargings.

STEP 1 – Meet The Team

When we met with the team back in 2016 during the conference, we knew they might be onto something. The experienced founders have been working hand in hand with tech giants such as Samsung and Apple on battery improvements for years. After Jacek has helped them out to settle in Rzeszów, they have started researching a solution that uses significantly less raw materials than other solid-state batteries. We already knew that many industries are flirting with the idea of solid electrolyte instead of the traditional one.

STEP 2 – Prioritise With a Laser-Focused Team

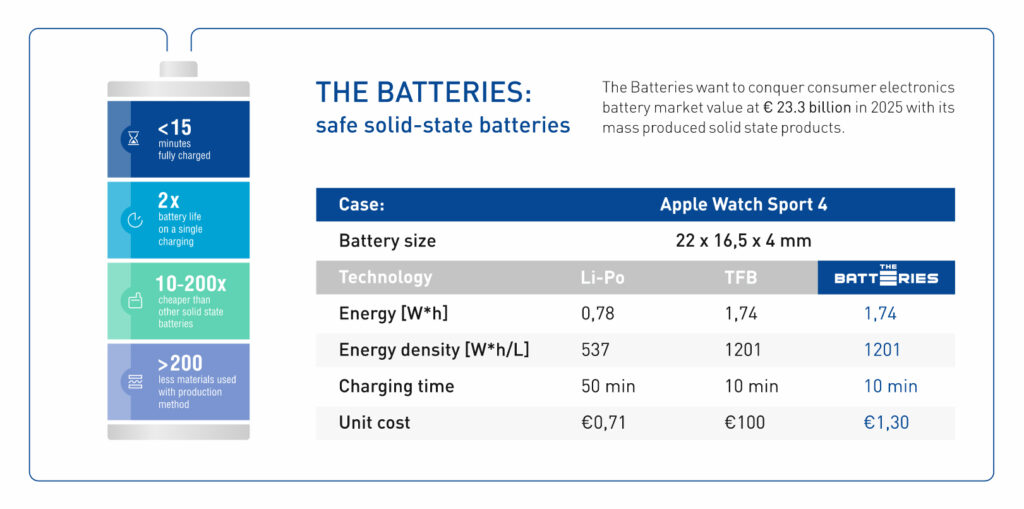

The Batteries has been keeping its eye on the ball, developing next-generation batteries. As one of only a few on the market, they kept in mind that creating the product as a whole (rather than particular elements) is crucial in this industry. It has led them to patent technology – with seed money from META Ventures (fund managed previously by the APER Ventures team), they have cracked the code that made scientists around the globe scratch their heads – how to mass-produce superbatteries that are safe and cheap.

In the past few years, we have been following the team’s R&D effort, resulting in the maximum reduction of the cost of production on a pilot scale. Seeing those accurate simulations of large-scale production costs, we wanted to make sure we further strengthen our “investment marriage” with the startup. We decided to lead the next round of $8.2M while inviting other investors to join us in the support. We have just announced said investment with January Ciszewski, EIT InnoEnergy and UAB Electronics System on board.

STEP 3 – Think About The Future

The team of engineers is a dream for the investor, isn’t it? The Batteries team has focused on validating competitive advantages with such thoroughness one can only see in the deeptech industry. But one might worry about building business acumen.

That’s where Alex, the company’s COO, enters to introduce the other side of the equation. The person we see weekly in our office. Dealing with all things non-tech – building partnerships, recruiting team members, meeting with investors at conferences and more – he was pushing for the leading position of The Batteries in the global solid-state market through partnerships – including a stamp of approval from the University of Cambridge as a company “revolutionising the market of consumer electronics batteries”.

While we supported the team in focusing on validating their solution and testing technical hypotheses, they couldn’t forget when commercialisation would be critical.

NEXT STEP – A MARATHON…

The Batteries’ success with their Series A leads us to help them network and look for commercial opportunities since focusing to such an extent on the research for the past few years was not a choice they made on a whim.

With the introduction of mass production in Rzeszów, we have some expectations and plans with The Batteries team. Especially when on the horizon, we already see the next goal for our alliance – to list the company on the WSE through a reverse acquisition (so-called SPAC).

Discover superbatteries on thebatt.tech

About Aper Ventures

The fund supports deeptech and hardware startups that demonstrate proven competitive advantages and significant global potential. Originally, the team has managed founded in 2014 as a 100 million PLN Meta Ventures, investing in more than 20 entities. As of 2019, it makes investments primarily under Aper Ventures with support of network from Aper Angels. The value of its assets under management is around 130 million PLN, of which only since 2019 the fund has invested 50 million PLN. It has three companies in its portfolio: The Batteries, Surge Cloud and Talent Alpha.

If you believe that your company might be a good fit to our portfolio, tell us a little bit about your business and your team. We typically have a lot of applications so give us some time to respond → SUBMIT AN APPLICATION